When It's Time to Think About TAXES

Before sitting down to prepare your income tax return, you should identify and gather the necessary documents, to ensure that all of your income, deductions and credits are properly reported.

Since most income is reported to the Internal Revenue Service by third parties (e.g. W-2's and 1099's); a failure to report income will probably be caught by the IRS during the tax form reconciliation process. Unfortunately, due to the inherent time delay in the reconciliation process, a failure to report taxable income will likely result in a liability for unpaid taxes, as well as accumulated penalty and interest charges. As such, you should make the best effort to include all earned income on your tax return.

While there are some information returns submitted to the IRS by third parties, related to tax deductions (e.g. form 1098), there are a number of tax deductible items that are not reported to the IRS by third parties. The burden is on you to ensure that all of your tax deductions and credits are properly documented, in the event of an audit.

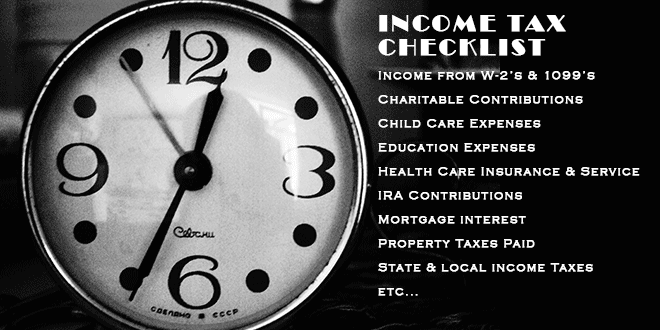

The following is a list of Income types, deductions and credits, commonly found on individual income tax returns:

INCOME

DEDUCTIONS and CREDITS

This is not meant to be an all-inclusive list. Your income, deductions and credits are based on your financial activity. A review of your prior year tax return, might reveal additional items to be added to this list. Start the information gathering process as soon as possible, to avoid the last-minute rush that will possibly result in a failure to capture all pertinent data related to your income tax return.

Get product update information and exclusive offers directly to your inbox. |